Flexible Spending Account (FSA)

TAX-FREE MONEY FOR YOUR FAMILY’S HEALTHCARE NEEDS

Flexible Spending Accounts enable consumers to budget for qualified expenses and contain cost through tax savings.

FSA Administration

At CPI, we work hard to achieve stress-free FSA administration for our clients and their employees while utilizing substantiation procedures that ensure plan compliance. Health FSAs, Dependent Care FSAs and debit card technology are fully integrated in one comprehensive platform for streamlined management. Our program also offers access through separate employer and employee portals.

Employers can view plans, access resources, review employee data, and manage reports, while the employee portal allows for online claim submissions as well as access to reimbursement history and FSA balances. Our modern, cloud-based setup allows for secure, reliable access for all parties. Please review our FSA Administration services below.

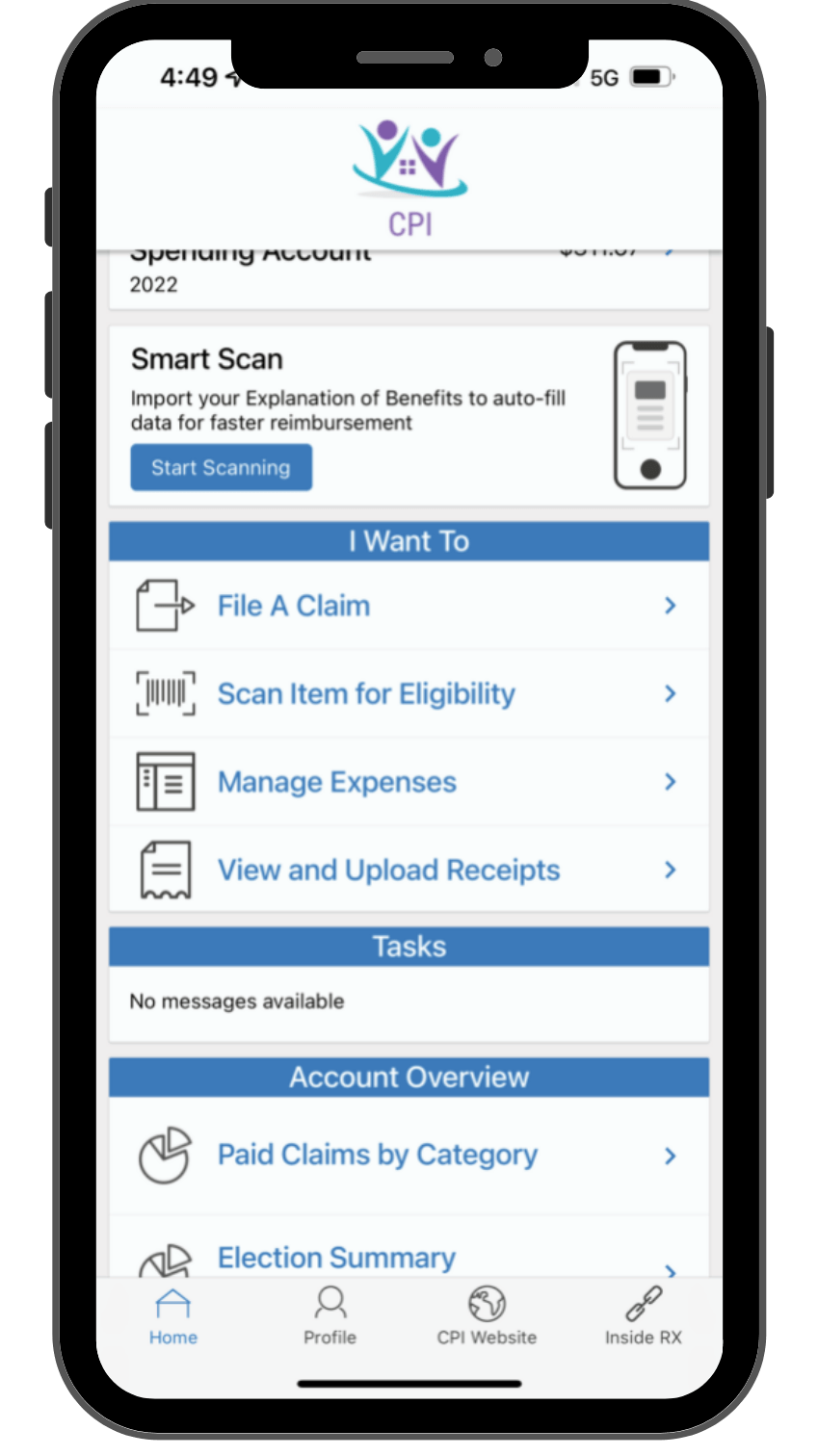

STAY CONNECTED

myCPI Medical app allows employees to submit claims, view balances, quickly and easily access funds.

FSA ADMINISTRATION SERVICES:

- Flexible options:

- 90-day run out

- $570/year rollover (can change annually)

- 2 1/2 month grace period extension

- Preparation of Plan Document

- Summary Plan Description (SPD)

- Employee enrollment materials

- Debit card option

- Receive, adjudicate, & process all claims

- Weekly participant reimbursement processing

- Secure online platform with access to real-time data for both the employer and participants

- Maintenance of claim records and reimbursements

- Non-discrimination testing (upon request)

FSA PARTICIPATION IS INCREASING!

Our comprehensive platform will provide streamlined plan management for employers and participants.

Participation in Flexible Spending Accounts is

on the rise due to recent regulatory changes allowing the opportunity to carry over unused funds.

Increased participation will result in increased tax savings to employers and employees.

FAQs

Ultimate Guide to FSAs

Consumer Handouts

Consumer handouts are a vital tool for education and communication. They serve as tangible resources that individuals can refer to at their convenience, ensuring that important information is not forgotten after a presentation or meeting. Handouts can reinforce messages, provide step-by-step instructions, and offer a summary of key points that can help in decision-making processes.

List of Services

-

Flexible Spending Account (FSA)List Item 1

What is an FSA ?

-

Dependent Care (DCFSA)List Item 2

Why should I choose a Dependent Care Flexible Spending Account (FSA)?

-

Over the Counter (OTC) Write a description for this list item and include information that will interest site visitors. For example, you may want to describe a team member's experience, what makes a product special, or a unique service that you offer.

List Item 3