Solutions for Benefits Participants

The annual enrollment period is an important time of year. Take the opportunity to understand your benefits and compare available options. Your wallet will thank you.

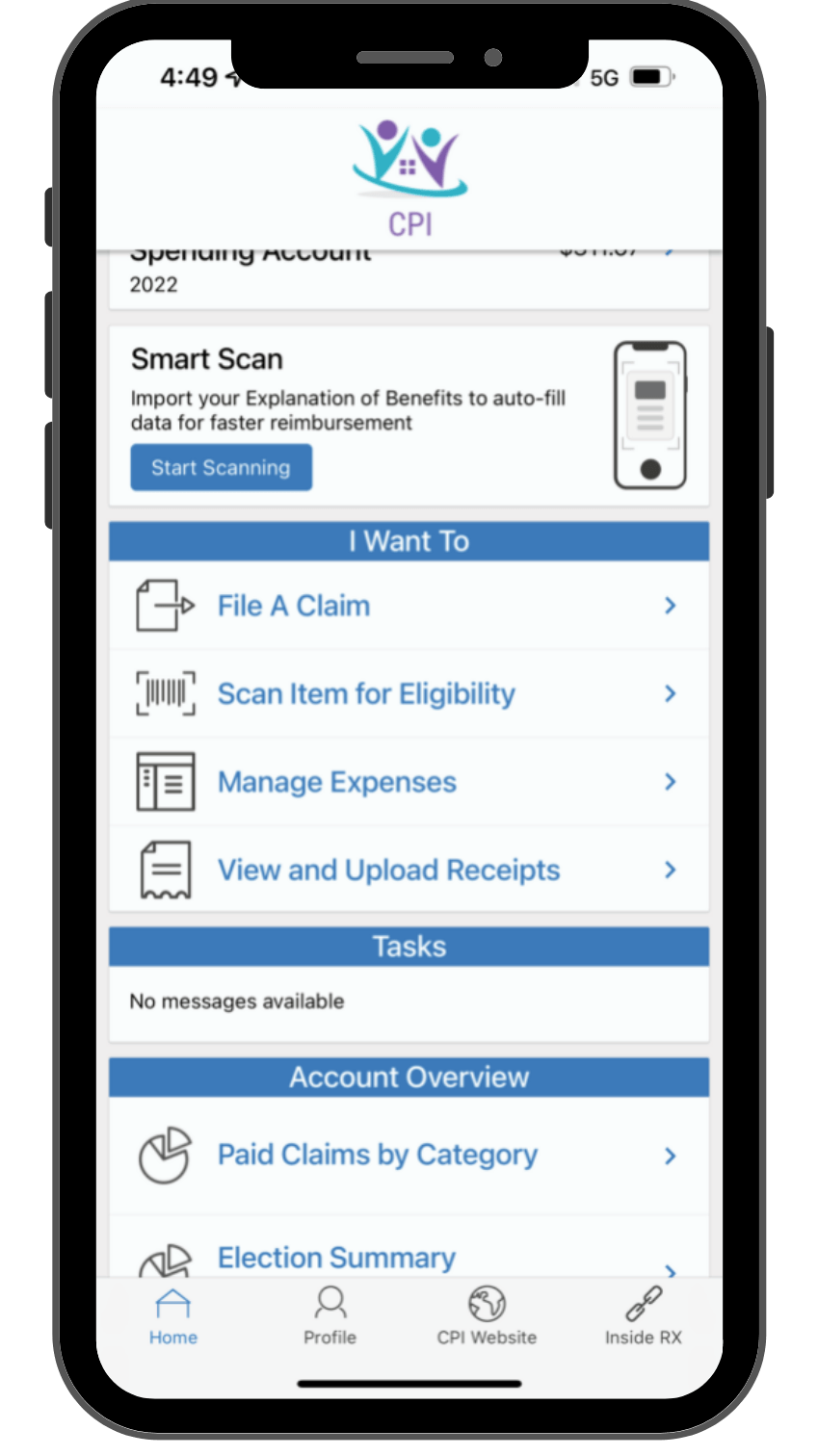

Manage your Reimbursements on the go.

Download MYCPI Medical App

Stay Up to Speed

Get to the healthcare account information you need—fast.

Scan Expenses

Scan a product barcode to help determine eligibility as a qualified medical expense.

Check Balances

Check your healthcare account balances quickly and easily.

Make Payments Quickly

Record a health expense and capture the receipt the moment the transaction happens.

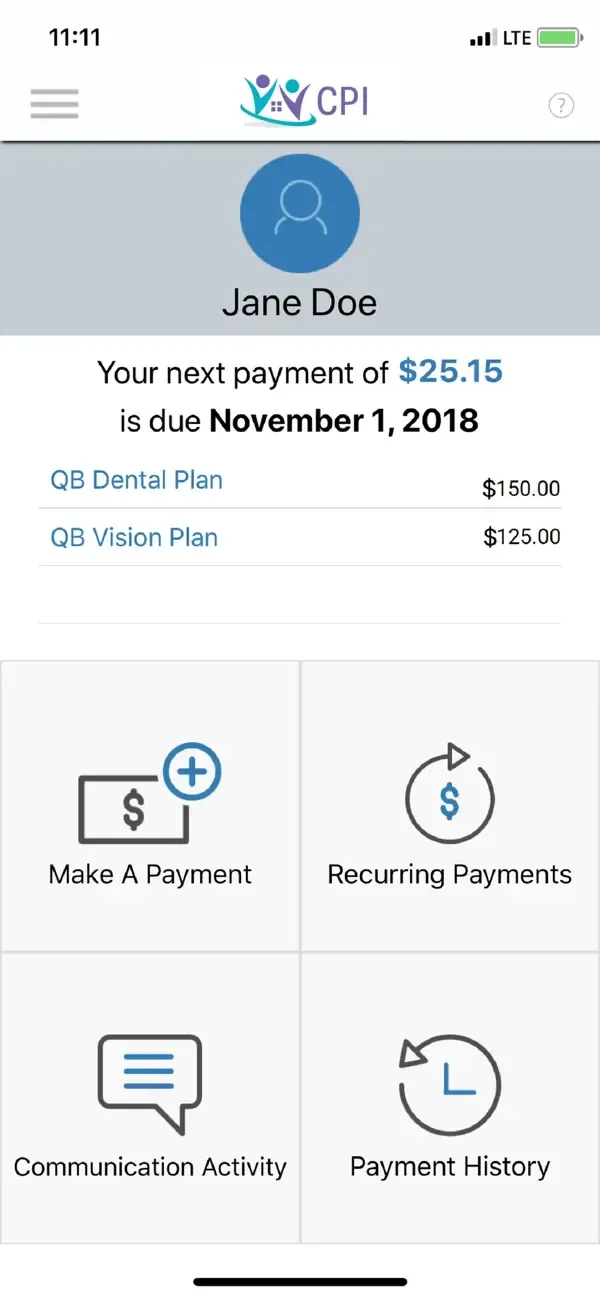

Manage your Plans 24/7 on the go.

DOWNLOAD THE CPI COBRA + DIRECT BILL MOBILE APP

Stay Up to Date

Get visibility on payments to your plan.

Elections

Avoid the hassle of paper by utilizing the latest secure technology.

The Complete FSA Eligibility List

The most-comprehensive eligibility list available on the web. From A to Z, items and services deemed eligible for tax-free spending with your Flexible Spending Account (FSA), Health Savings Account (HSA), Health Reimbursement Arrangement (HRA) and more will be here, complete with details and requirements. Important Reminder: FSAs, HRAs and other account types listed may not all be the same. Be sure to check with your administrator to confirm if something is eligible before making a purchase.

Maximize the Value of Your HSA and/or FSA

Your Health Care Flexible Spending Account (FSA) and/or Health Savings Account (HSA) dollars can be used for a variety of out-of-pocket health care expenses that qualify as federal income tax deductions under Section 213(d) of the Internal Revenue Code ("IRC").