Health Savings Account (HSA)

POWERING HEALTH SAVINGS

A health savings account is a tax-advantaged bank account available to taxpayers who are enrolled in an (HSA) qualified high-deductible health plan (HDHP).

HSA TAX BENEFITS

HSAs offer triple tax benefits, making them one of the most tax advantaged accounts available.

DEPOSITS TO YOUR HSA ARE FREE OF FEDERAL INCOME TAX AND STATE INCOME TAX (IN MOST STATES INCLUDING LOUISIANA AND TEXAS)

INTEREST AND INVESTMENT EARNINGS, WITHIN THE ACCOUNT ACCUMULATE TAX FREE

ALL WITHDRAWALS FROM THE ACCOUNT SPENT ON QUALIFIED MEDICAL EXPENSES ARE TAX FREE

HSA Services

At CPI, we offer our clients HSA administration. By combining decades of experience with consumer-driven design and technological innovation, we provide employers and employees with transparency and a paperless, digital way to manage their health savings account.

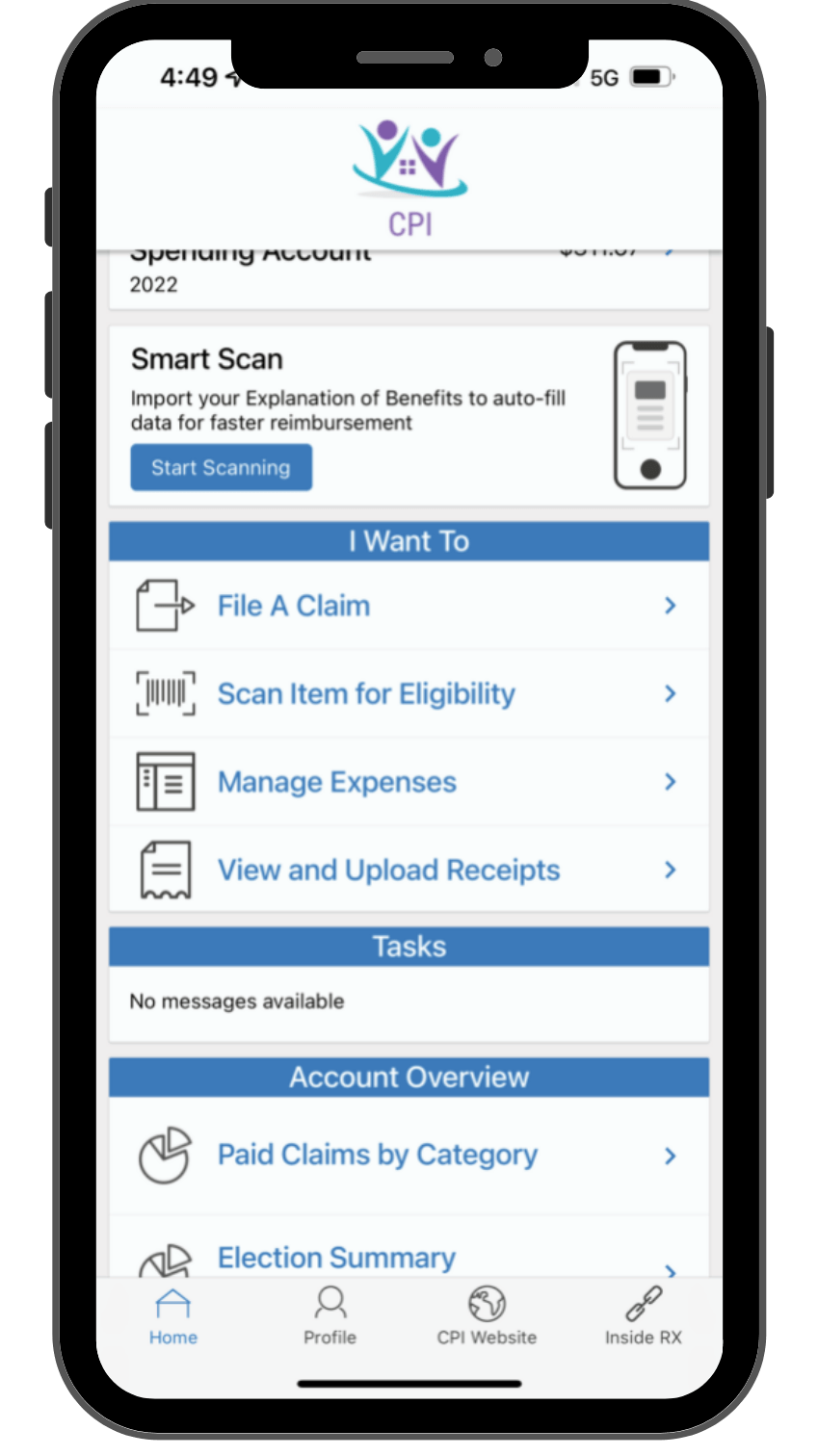

STAY CONNECTED

myCPI Medical app allows employees to submit claims, view balances, quickly and easily access funds.

HSA ADMINISTRATION SERVICES:

- Single-Fee HSA

- Proprietary industry first technology

- Dedicated customer success account manager for all group sizes

- Dedicated onboarding manager for all group sizes

- MOBILE app to manage HSA account

- Robust employer dashboard syncs with any payroll provider

- Deductible tracker syncs with any insurance carrier

- Access to real-time balance information, transfer

status updates, debit card activation, etc.

ADDITIONAL SERVICES:

- Investments via TD Ameritrade

- First Dollar-Personalized Investing

- Starter Penny

- HSA calculators

- Ongoing HSA education blog series